3.1 What are Prop Firms?

Prop firms (short for proprietary trading firms) are setups where traders use the firm’s capital to trade, and profits are split between the trader and the firm. Traditionally, these were physical firms with in-house traders. But in recent years, online prop firms have exploded, giving retail traders a shot at trading with firm capital through evaluation challenges.

To get funded, you must hit a profit target without exceeding certain drawdowns or daily loss limits — basically proving you can trade responsibly.

Most modern prop firms focus on futures trading, and traders must close all positions by the end of the day. Traditional firms, by contrast, can hold overnight positions and trade a wider range of instruments.

Not all prop firms are equal — many pop up and disappear quickly. So, always go with reputable firms that have fair rules and good trader support.

3.2 Why Use Prop Firms?

Prop firms can help two main groups of traders.

1. Beginners learning the ropes:

If you’re just starting out, you absolutely need exposure to tools, execution, and real market dynamics. Why risk your own hard-earned money during the inevitable 2-3 year learning curve?

Think of it: you can get a cheap prop firm evaluation account for less than $20. Even if you trade that for two years ($20 x 24 months = $480), that’s less than 1% of what many new traders lose from their personal accounts! Trust me, I lost six figures in my early days—and I wish these firms existed then! Prop firms let you hone your strategy without the gut-wrenching pain of losing your own capital.

2. Experienced, consistent traders:

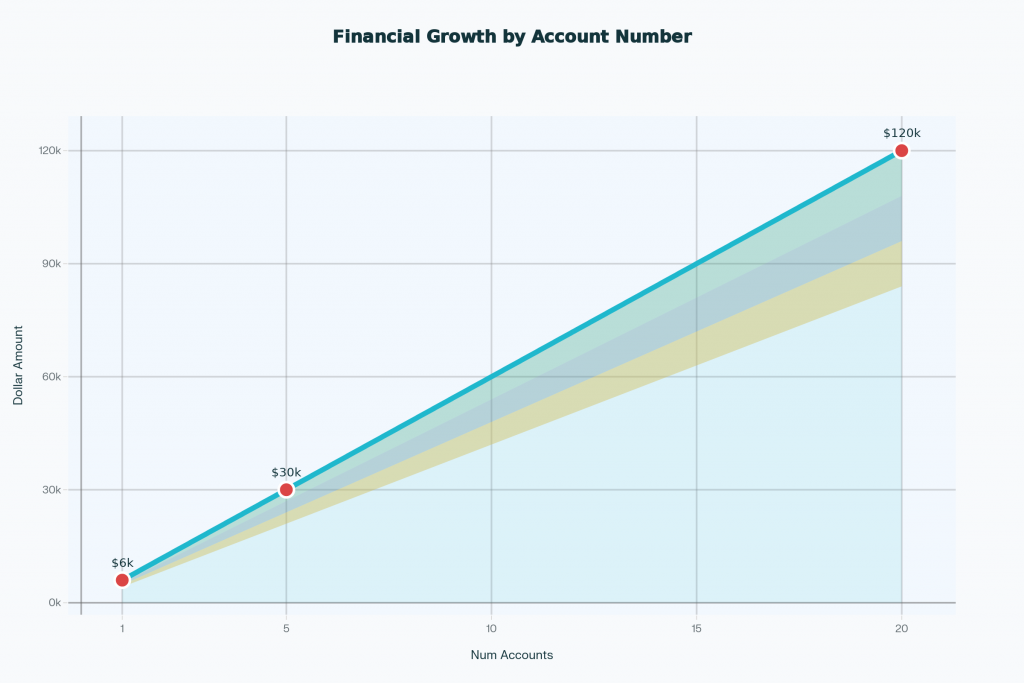

If you already trade profitably, prop firms let you scale your capital fast. Many allow traders to run multiple accounts simultaneously — sometimes up to 20. Imagine making $300 a day per account:

- 1 account = $6,000/month

- 5 accounts = $30,000/month

- 20 accounts = $120,000/month

That’s the power of compounding consistent performance across multiple accounts.

When you reach the funded stage, focus on consistency and following the rules rather than trying to hit home runs. Treat it like real capital — because it is.

Learn more about copy trading here:

3.3 What to Look Out For in a Prop Firm

- Long-Term Partnership: Firm supports account growth and trader development.

- Profit Split: Fair share of profits (typically 90–70%) for the trader.

- Rules: Realistic daily loss limits, drawdowns, and strategy restrictions.

- Fees: Transparent and reasonable evaluation/data costs.

- Support: Access to education, mentorship, and responsive help.