I mainly trade when price is at either Supply/Demand, Support/Resistance or at a level of interest based on the Order Flow. I look for buyer/sellers using OrderFlow tools like Bookmap to enter a trade. I have many playbooks which I’m planning to put it in a Video Series Soon but for now I’ll give few trade setups examples

6.1 Trapped sellers and Passive Buyers to go long

This is a classic accumulation-to-breakout and short squeeze setup. Strong passive buyers absorbed heavy selling near the lows (+700 passive buying). Sellers kept shorting into this demand zone, but buyers held firm, forming a base. Once price broke above the descending trendline, aggressive market buys (large green dots) triggered a breakout. The trapped sellers (circled) had to cover, adding fuel to the rally. Liquidity above was thin, and the rising CVD confirmed strong buy pressure — leading to a clean breakout continuation.

Key points:

- +700 passive buys: strong accumulation at support

- Base formation: repeated defense by buyers

- Breakout: large green dots = aggressive buy volume

- Trapped sellers: shorts forced to cover

- Follow-through: thin liquidity above, CVD rising → sustained move

6.2 Seeing buyers at a level of interest

Price first hit a strong 5M demand zone, shown by large green dots absorbing aggressive sell pressure. Despite heavy selling, price failed to push lower — signaling passive buyers defending that level. As price broke the descending trendline, a clear shift in market control occurred from sellers to buyers. Aggressive buying increased, supported by strong liquidity absorption below and a rising CVD. The long entry near the breakout level led to a 15-point continuation, with trapped shorts forced to exit into rising buy momentum.

Key points:

- Strong 5M demand zone: heavy absorption of sell volume

- Trendline break: structure shift confirming buyer control

- Aggressive buying: large green dots = strong initiative buys

- Rising CVD: confirms buyers dominating tape

- Trapped sellers: shorts covering fueled continuation

- Outcome: ~15 pts upside follow-through after long entry

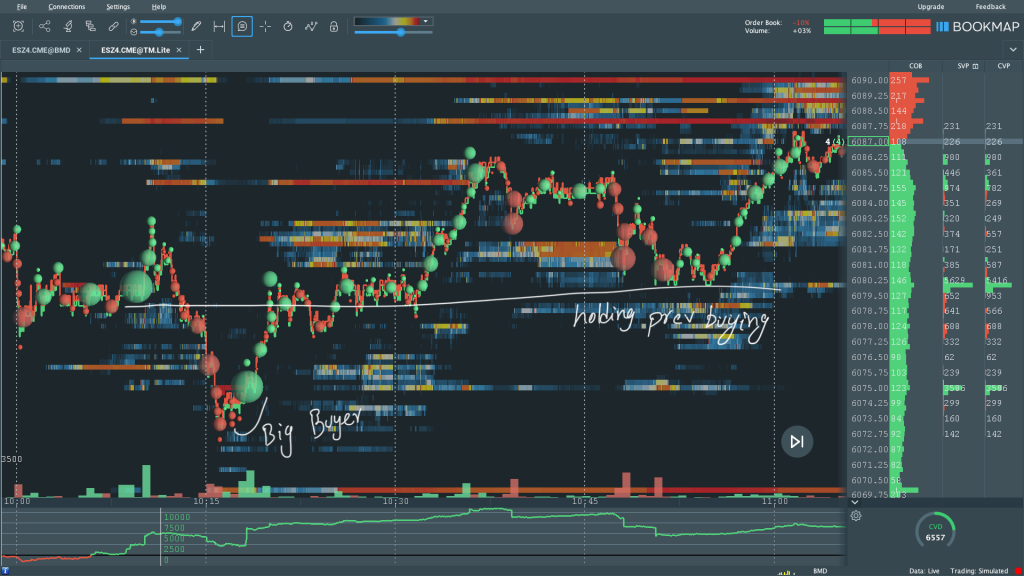

6.3 Large buyers holding the price

After an initial selloff, a big buyer stepped in aggressively (large green bubble), absorbing heavy selling and reversing momentum. Following that, price consolidated above this absorption area, holding the previous buying zone with smaller green dots continuously defending bids. This showed that buyers were still active and absorbing any small sell pressure. The consistent liquidity support (horizontal blue heatmap levels) below confirmed passive demand holding firm. Once sellers exhausted, buyers reinitiated control, leading to a clean continuation leg higher.

Key points:

- Big Buyer Absorption: strong aggressive buy reaction after selloff reversal.

- Support holding: previous buying zone defended multiple times.

- Liquidity behavior: passive bids remained steady under structure.

- CVD rising: confirming sustained buyer control through consolidation.

- Outcome: bullish continuation with higher lows and trapped sellers squeezed.

6.4 Buyers buying while price going down.

A sharp initial move down was met by large green bubbles (aggressive buying) executing at consecutively lower prices. This indicates significant absorption as large buyers were purchasing contracts even while the price was falling, a classic sign of accumulation. Despite this aggressive demand, the price formed initial lower lows, suggesting heavy selling was being absorbed. Crucially, passive limit order support (blue heatmap) established a firm structural demand zone around the $5130 – $5135 area. This confluence of aggressive buying and passive support successfully exhausted the sellers. Once selling pressure subsided, the buyers took control, leading to a sharp bullish reversal and a clean break higher. The rising CVD during the absorption phase would confirm sustained buyer activity despite the temporary price drop.

Key Points:

- Aggressive Absorption: Large green bubbles visible on a downtrend, confirming aggressive professional buying “buying while going down.”

- Structural Support: Passive limit bids (blue heat) established a firm structural floor, creating a strong demand zone.

- Seller Exhaustion: The rate of new lows slowed before the reversal.

- Outcome: Bullish reversal and a sustained move higher, confirming the absorption was successful accumulation.

These are some of the long setups I looks and for short setup, I look at opposite version ex: Trapped Buyers and Passive Sellers to go short